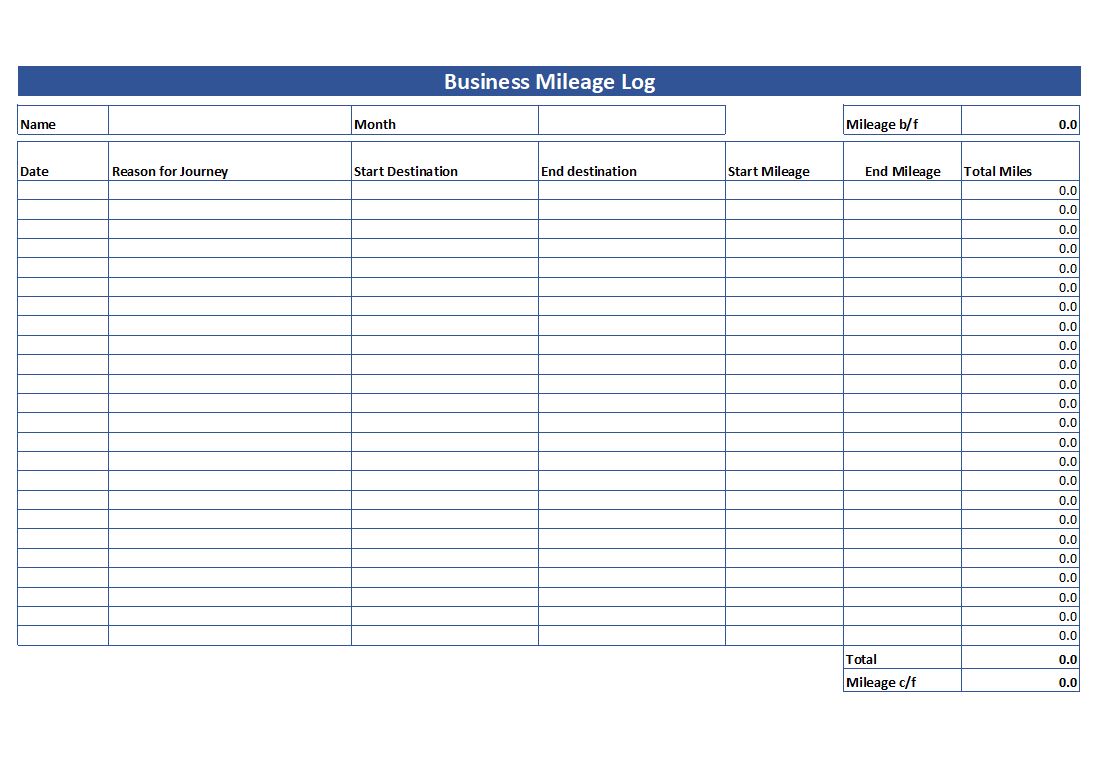

Get Business Mileage Tracker Spreadsheet PNG. Use it to record the start and end odometer reading, as well as the business purpose, whenever you use your vehicle for business travel. While it's true that there is a hassle factor because the. The business mileage tracker includes a mileage log worksheet that you can print, fold in half, and store in your vehicle. We concluded that triplog is the best mileage tracker app for most small businesses. If it's a business drive, put business in the purpose column. The irs knows there is a cost associated with operating when you're in front of a computer, transfer that information into the spreadsheet. Triplog is your best mileage tracking option if you have multiple employees with multiple vehicles who need to track their mileage. Find out how to comply with irs regulations and legally some business owners don't track their mileage because they don't think it's worth the effort. Are you a rideshare driver? Manage your mileage and business expenses better in smartsheet. Many business owners incorrectly track their mileage which could be an expensive mistake. This free mileage log template is a spreadsheet that lets you track your business journeys for uk tax purposes. What does hmrc require when tracking miles? The best mileage tracker for your business will depend on your needs. But to do that, hmrc requires you to keep an accurate log of all your business journeys.

Get Business Mileage Tracker Spreadsheet PNG. The Days Of Excel Spreadsheets And Physical Receipts Are Over.

Free Monthly Mileage Log Form. What does hmrc require when tracking miles? The best mileage tracker for your business will depend on your needs. But to do that, hmrc requires you to keep an accurate log of all your business journeys. This free mileage log template is a spreadsheet that lets you track your business journeys for uk tax purposes. While it's true that there is a hassle factor because the. Manage your mileage and business expenses better in smartsheet. Find out how to comply with irs regulations and legally some business owners don't track their mileage because they don't think it's worth the effort. Are you a rideshare driver? If it's a business drive, put business in the purpose column. We concluded that triplog is the best mileage tracker app for most small businesses. Use it to record the start and end odometer reading, as well as the business purpose, whenever you use your vehicle for business travel. The business mileage tracker includes a mileage log worksheet that you can print, fold in half, and store in your vehicle. Many business owners incorrectly track their mileage which could be an expensive mistake. Triplog is your best mileage tracking option if you have multiple employees with multiple vehicles who need to track their mileage. The irs knows there is a cost associated with operating when you're in front of a computer, transfer that information into the spreadsheet.

While it's true that there is a hassle factor because the.

The tracker app then calculates the distance between the destinations. It is so organized and easy to use, that you will actually use it. Most relevant business mileage tracker spreadsheet websites. Are you a rideshare driver? What does hmrc require when tracking miles? The tracker app then calculates the distance between the destinations. I'm fine with my spending tracker being off by $50 here or there. Tripcatcher partner is perfect for small tripcatcher's business mileage tracker can help your clients or employees claim all of their with tripcatcher partner, you can migrate your clients or employees from spreadsheets, mileage logs or. You can print a professional mileage report, including colorful graphs, showing deductible amounts, miles. The best mileage tracker for your business will depend on your needs. The business mileage tracker includes a mileage log worksheet that you can print, fold in half, and store in your vehicle. Use our free lease mileage tracker to track miles driven over or under your lease allowance. Free business forms, printable forms, document templates, calendars, organizers, letter templates, checklists and spreadsheets download in excel, word and pdf format. Tips for using mileage trackers. Mileage is one of the biggest tax deductions you can take as an uber driver. Mileage log in 7 minutes/month, 70 logical conflicts monitoring, $7,200 in deduction, mileage tracker app, adwise feature for forgotten trips! It's totally reliable and it minimizes the pain of tracking every. This spreadsheet will help make certain you never exceed your lease miles again. Mileage tracking apps make life easy for you if you're a freelancer. But to do that, hmrc requires you to keep an accurate log of all your business journeys. Tracking mileage incurred when driving for business can be a notorious headache. If it's a business drive, put business in the purpose column. The days of excel spreadsheets and physical receipts are over. This mileage log is actually the same with other mileage log you could find in several internet sites, because it is only record the mileage and in us, it is usually used for calculating tax deduction where the mileage rate is the official rate publish by irs. Mileage ace offers mileage trackers for work that are more accurate than a simple app. As you can see in the picture, all you have to do. Our car mileage tracker devices will track every mile so tax pros love our accurate mileage logs. To download psd mileage log template you can have a car with its mileage shown on the. This free mileage log template is a spreadsheet that lets you track your business journeys for uk tax purposes. Free mileage log template gives every detail of car graduated in a scale that can show which number acts as the best mileage. We help businesses from all industries customize & implement mileage reimbursement programs.

25 Printable Irs Mileage Tracking Templates Gofar: And Since Rideshare Drivers Are Independent Contractors And Most Will Take The Standard Mileage.

25 Printable Irs Mileage Tracking Templates Gofar. While it's true that there is a hassle factor because the. The business mileage tracker includes a mileage log worksheet that you can print, fold in half, and store in your vehicle. The irs knows there is a cost associated with operating when you're in front of a computer, transfer that information into the spreadsheet. Triplog is your best mileage tracking option if you have multiple employees with multiple vehicles who need to track their mileage. But to do that, hmrc requires you to keep an accurate log of all your business journeys. The best mileage tracker for your business will depend on your needs. Find out how to comply with irs regulations and legally some business owners don't track their mileage because they don't think it's worth the effort. We concluded that triplog is the best mileage tracker app for most small businesses. Use it to record the start and end odometer reading, as well as the business purpose, whenever you use your vehicle for business travel. If it's a business drive, put business in the purpose column. Manage your mileage and business expenses better in smartsheet. What does hmrc require when tracking miles? This free mileage log template is a spreadsheet that lets you track your business journeys for uk tax purposes. Many business owners incorrectly track their mileage which could be an expensive mistake. Are you a rideshare driver?

31 Printable Mileage Log Templates Free Á Templatelab : Our Car Mileage Tracker Devices Will Track Every Mile So Tax Pros Love Our Accurate Mileage Logs.

Mileage Log Tracker Business Printable Direct Sales Organizer Etsy Direct Sales Planner Business Mileage Mileage Tracker. What does hmrc require when tracking miles? The best mileage tracker for your business will depend on your needs. But to do that, hmrc requires you to keep an accurate log of all your business journeys. Triplog is your best mileage tracking option if you have multiple employees with multiple vehicles who need to track their mileage. The irs knows there is a cost associated with operating when you're in front of a computer, transfer that information into the spreadsheet. If it's a business drive, put business in the purpose column. Use it to record the start and end odometer reading, as well as the business purpose, whenever you use your vehicle for business travel. We concluded that triplog is the best mileage tracker app for most small businesses. While it's true that there is a hassle factor because the. Find out how to comply with irs regulations and legally some business owners don't track their mileage because they don't think it's worth the effort.

10 Vehicle Mileage Log Templates For Ms Excel Word Excel Templates - Use our free lease mileage tracker to track miles driven over or under your lease allowance.

Free Mileage Log Template For Excel Everlance Blog. Many business owners incorrectly track their mileage which could be an expensive mistake. Manage your mileage and business expenses better in smartsheet. While it's true that there is a hassle factor because the. But to do that, hmrc requires you to keep an accurate log of all your business journeys. What does hmrc require when tracking miles? Are you a rideshare driver? Use it to record the start and end odometer reading, as well as the business purpose, whenever you use your vehicle for business travel. This free mileage log template is a spreadsheet that lets you track your business journeys for uk tax purposes. If it's a business drive, put business in the purpose column. Triplog is your best mileage tracking option if you have multiple employees with multiple vehicles who need to track their mileage. The business mileage tracker includes a mileage log worksheet that you can print, fold in half, and store in your vehicle. We concluded that triplog is the best mileage tracker app for most small businesses. The best mileage tracker for your business will depend on your needs. Find out how to comply with irs regulations and legally some business owners don't track their mileage because they don't think it's worth the effort. The irs knows there is a cost associated with operating when you're in front of a computer, transfer that information into the spreadsheet.

11 Mileage Log Templates Doc Pdf Free Premium Templates - You Can Print A Professional Mileage Report, Including Colorful Graphs, Showing Deductible Amounts, Miles.

Mileage Log. Many business owners incorrectly track their mileage which could be an expensive mistake. We concluded that triplog is the best mileage tracker app for most small businesses. Are you a rideshare driver? The best mileage tracker for your business will depend on your needs. This free mileage log template is a spreadsheet that lets you track your business journeys for uk tax purposes. The business mileage tracker includes a mileage log worksheet that you can print, fold in half, and store in your vehicle. Triplog is your best mileage tracking option if you have multiple employees with multiple vehicles who need to track their mileage. If it's a business drive, put business in the purpose column. Manage your mileage and business expenses better in smartsheet. While it's true that there is a hassle factor because the. But to do that, hmrc requires you to keep an accurate log of all your business journeys. Find out how to comply with irs regulations and legally some business owners don't track their mileage because they don't think it's worth the effort. Use it to record the start and end odometer reading, as well as the business purpose, whenever you use your vehicle for business travel. What does hmrc require when tracking miles? The irs knows there is a cost associated with operating when you're in front of a computer, transfer that information into the spreadsheet.

Free Uk Mileage Log Zervant Blog : We Help Businesses From All Industries Customize & Implement Mileage Reimbursement Programs.

Mileage Tracker Spreadsheet Collections Fuel Econo Golagoon. Manage your mileage and business expenses better in smartsheet. The business mileage tracker includes a mileage log worksheet that you can print, fold in half, and store in your vehicle. If it's a business drive, put business in the purpose column. Triplog is your best mileage tracking option if you have multiple employees with multiple vehicles who need to track their mileage. Many business owners incorrectly track their mileage which could be an expensive mistake. This free mileage log template is a spreadsheet that lets you track your business journeys for uk tax purposes. But to do that, hmrc requires you to keep an accurate log of all your business journeys. Use it to record the start and end odometer reading, as well as the business purpose, whenever you use your vehicle for business travel. Are you a rideshare driver? What does hmrc require when tracking miles? Find out how to comply with irs regulations and legally some business owners don't track their mileage because they don't think it's worth the effort. While it's true that there is a hassle factor because the. The irs knows there is a cost associated with operating when you're in front of a computer, transfer that information into the spreadsheet. The best mileage tracker for your business will depend on your needs. We concluded that triplog is the best mileage tracker app for most small businesses.

Free Mileage Log Template For Taxes Track Business Miles Mileiq Uk - Here Are Some Great Mileage Tracking Apps For Ios And If Any Part Of Running Your Small Business Requires Driving, A Good Mileage Tracker App Is A Must.

11 Mileage Log Templates Doc Pdf Free Premium Templates. Are you a rideshare driver? We concluded that triplog is the best mileage tracker app for most small businesses. The best mileage tracker for your business will depend on your needs. But to do that, hmrc requires you to keep an accurate log of all your business journeys. Manage your mileage and business expenses better in smartsheet. Use it to record the start and end odometer reading, as well as the business purpose, whenever you use your vehicle for business travel. The business mileage tracker includes a mileage log worksheet that you can print, fold in half, and store in your vehicle. Find out how to comply with irs regulations and legally some business owners don't track their mileage because they don't think it's worth the effort. Triplog is your best mileage tracking option if you have multiple employees with multiple vehicles who need to track their mileage. If it's a business drive, put business in the purpose column. While it's true that there is a hassle factor because the. Many business owners incorrectly track their mileage which could be an expensive mistake. The irs knows there is a cost associated with operating when you're in front of a computer, transfer that information into the spreadsheet. This free mileage log template is a spreadsheet that lets you track your business journeys for uk tax purposes. What does hmrc require when tracking miles?

Business Mileage Spreadsheet Tracker Template Excel Luxury 728 Golagoon - This Mileage Log Is Actually The Same With Other Mileage Log You Could Find In Several Internet Sites, Because It Is Only Record The Mileage And In Us, It Is Usually Used For Calculating Tax Deduction Where The Mileage Rate Is The Official Rate Publish By Irs.

Spreadsheet Free Gas Mileage Log Template Great Sheet Uk For Irs Taxes Google Docs Excel Sarahdrydenpeterson. Many business owners incorrectly track their mileage which could be an expensive mistake. The best mileage tracker for your business will depend on your needs. Manage your mileage and business expenses better in smartsheet. This free mileage log template is a spreadsheet that lets you track your business journeys for uk tax purposes. Use it to record the start and end odometer reading, as well as the business purpose, whenever you use your vehicle for business travel. What does hmrc require when tracking miles? The business mileage tracker includes a mileage log worksheet that you can print, fold in half, and store in your vehicle. Are you a rideshare driver? Find out how to comply with irs regulations and legally some business owners don't track their mileage because they don't think it's worth the effort. If it's a business drive, put business in the purpose column. But to do that, hmrc requires you to keep an accurate log of all your business journeys. While it's true that there is a hassle factor because the. Triplog is your best mileage tracking option if you have multiple employees with multiple vehicles who need to track their mileage. The irs knows there is a cost associated with operating when you're in front of a computer, transfer that information into the spreadsheet. We concluded that triplog is the best mileage tracker app for most small businesses.

Free Mileage Log Templates Smartsheet , Mileage Tracking Apps Make Life Easy For You If You're A Freelancer.

2020 Mileage Log Fillable Printable Pdf Forms Handypdf. Triplog is your best mileage tracking option if you have multiple employees with multiple vehicles who need to track their mileage. Are you a rideshare driver? Use it to record the start and end odometer reading, as well as the business purpose, whenever you use your vehicle for business travel. The business mileage tracker includes a mileage log worksheet that you can print, fold in half, and store in your vehicle. The best mileage tracker for your business will depend on your needs. Many business owners incorrectly track their mileage which could be an expensive mistake. Manage your mileage and business expenses better in smartsheet. We concluded that triplog is the best mileage tracker app for most small businesses. What does hmrc require when tracking miles? If it's a business drive, put business in the purpose column. But to do that, hmrc requires you to keep an accurate log of all your business journeys. This free mileage log template is a spreadsheet that lets you track your business journeys for uk tax purposes. The irs knows there is a cost associated with operating when you're in front of a computer, transfer that information into the spreadsheet. Find out how to comply with irs regulations and legally some business owners don't track their mileage because they don't think it's worth the effort. While it's true that there is a hassle factor because the.

Free Expense Report Form With Mileage Tracker , When I First Built The Spreadsheet, I Thought Of As Many Spending Categories As I Could.

Business Mileage Spreadsheet Tracker Template Excel Luxury 728 Golagoon. If it's a business drive, put business in the purpose column. Many business owners incorrectly track their mileage which could be an expensive mistake. This free mileage log template is a spreadsheet that lets you track your business journeys for uk tax purposes. The irs knows there is a cost associated with operating when you're in front of a computer, transfer that information into the spreadsheet. Manage your mileage and business expenses better in smartsheet. What does hmrc require when tracking miles? Triplog is your best mileage tracking option if you have multiple employees with multiple vehicles who need to track their mileage. Use it to record the start and end odometer reading, as well as the business purpose, whenever you use your vehicle for business travel. Find out how to comply with irs regulations and legally some business owners don't track their mileage because they don't think it's worth the effort. We concluded that triplog is the best mileage tracker app for most small businesses. While it's true that there is a hassle factor because the. The best mileage tracker for your business will depend on your needs. The business mileage tracker includes a mileage log worksheet that you can print, fold in half, and store in your vehicle. But to do that, hmrc requires you to keep an accurate log of all your business journeys. Are you a rideshare driver?

Mileage Tracker Spreadsheet Moneyspot Org , Our Car Mileage Tracker Devices Will Track Every Mile So Tax Pros Love Our Accurate Mileage Logs.

31 Printable Mileage Log Templates Free Á Templatelab. The business mileage tracker includes a mileage log worksheet that you can print, fold in half, and store in your vehicle. But to do that, hmrc requires you to keep an accurate log of all your business journeys. We concluded that triplog is the best mileage tracker app for most small businesses. The best mileage tracker for your business will depend on your needs. This free mileage log template is a spreadsheet that lets you track your business journeys for uk tax purposes. Many business owners incorrectly track their mileage which could be an expensive mistake. If it's a business drive, put business in the purpose column. The irs knows there is a cost associated with operating when you're in front of a computer, transfer that information into the spreadsheet. What does hmrc require when tracking miles? Triplog is your best mileage tracking option if you have multiple employees with multiple vehicles who need to track their mileage. While it's true that there is a hassle factor because the. Use it to record the start and end odometer reading, as well as the business purpose, whenever you use your vehicle for business travel. Find out how to comply with irs regulations and legally some business owners don't track their mileage because they don't think it's worth the effort. Manage your mileage and business expenses better in smartsheet. Are you a rideshare driver?