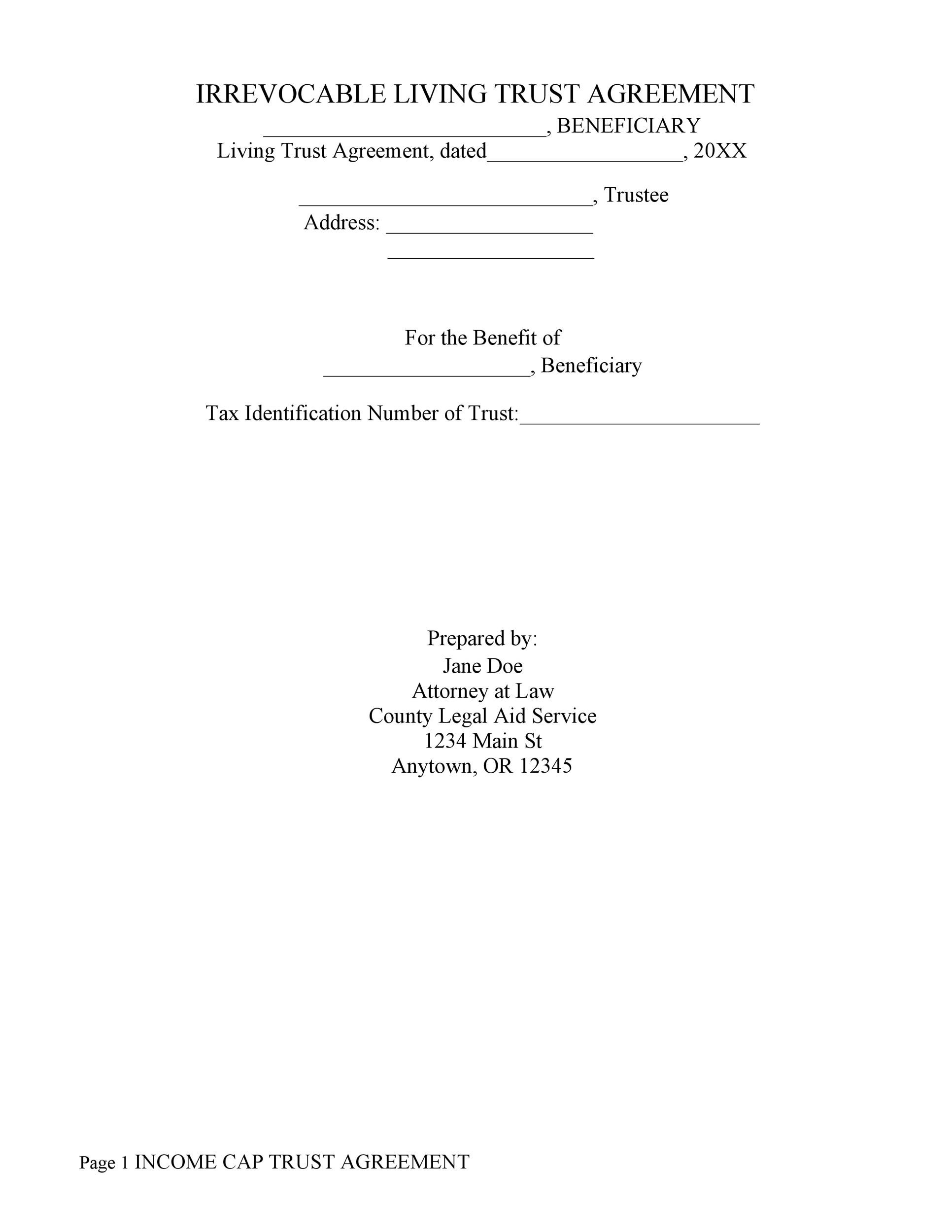

38+ Sample Irrevocable Trust Agreement Background. This agreement made and entered into the ___ day of __ , __ , by. This agreement and the trusts created hereunder are irrevocable. If at any time, in following the directions of this trust agreement, the trustees is required to distribute all or any part of the principal of the trust herein created outright to a person who is then. For an irrevocable trust agreement, the trustor grants control and ownership of the property to the trustee. 100%(3)100% found this document useful (3 votes). The grantor shall execute such further instruments as shall be necessary to vest the trustees with full title to the property which is the subject of this agreement. Savesave irrevocable living trust agreement for later. This trust shall be irrevocable and shall not be revoked or terminated by grantor or any other person, nor shall it be amended or altered by grantor or any other person. If you create an irrevocable trust not long before a creditor receives a judgment against you, it's likely a court will find the transfer invalid. There are myriad irrevocable trusts available, most designed for specific types of asset protection and tax benefits. A trust is a legal agreement by three parties that allows you as the trustor to transfer your property and assets to your beneficiaries. For this type of trust, the trustor no longer controls or owns the property which means that he can't make any. All types of trust agreements are either irrevocable or revocable. Trust agreement this trust agreement (the. (f) to vote upon all securities belonging to the trusts, and to become a party to any stockholders' agreements deemed advisable by them in.

38+ Sample Irrevocable Trust Agreement Background- A Revocable Trust Can Be Changed Or Cancelled.

Free Revocable Living Trust Forms Pdf Word Eforms Free Fillable Forms. If you create an irrevocable trust not long before a creditor receives a judgment against you, it's likely a court will find the transfer invalid. Trust agreement this trust agreement (the. For an irrevocable trust agreement, the trustor grants control and ownership of the property to the trustee. The grantor shall execute such further instruments as shall be necessary to vest the trustees with full title to the property which is the subject of this agreement. Savesave irrevocable living trust agreement for later. This agreement and the trusts created hereunder are irrevocable. All types of trust agreements are either irrevocable or revocable. This trust shall be irrevocable and shall not be revoked or terminated by grantor or any other person, nor shall it be amended or altered by grantor or any other person. If at any time, in following the directions of this trust agreement, the trustees is required to distribute all or any part of the principal of the trust herein created outright to a person who is then. This agreement made and entered into the ___ day of __ , __ , by. 100%(3)100% found this document useful (3 votes). (f) to vote upon all securities belonging to the trusts, and to become a party to any stockholders' agreements deemed advisable by them in. For this type of trust, the trustor no longer controls or owns the property which means that he can't make any. There are myriad irrevocable trusts available, most designed for specific types of asset protection and tax benefits. A trust is a legal agreement by three parties that allows you as the trustor to transfer your property and assets to your beneficiaries.

Check out the sample trust agreement linked to this article for example language and to see how i structured my own family trust.

This trust shall be irrevocable and shall not be revoked or terminated by grantor or any other person, nor shall it be amended or altered by grantor or any other person. By the way, i read your sample chapter on 'durable power of attorney'. A living trust is a legal form designed to the advantages of an irrevocable living trust form include reduced estate tax rates and protection a living trust agreement form declares that the grantor assigns the trustee to be held accountable for. For this type of trust, the trustor no longer controls or owns the property which means that he can't make any. Trust agreement and other business contracts, forms and agreeements. Trust agreement this trust agreement (the. Land trust agreement sample 4 pages. / free 8+ sample living trust forms in pdf | ms word. (f) to vote upon all securities belonging to the trusts, and to become a party to any stockholders' agreements deemed advisable by them in. There are myriad irrevocable trusts available, most designed for specific types of asset protection and tax benefits. Separate trusts for sample children. The grantor shall execute such further instruments as shall be necessary to vest the trustees with full title to the property which is the subject of this agreement. If at any time, in following the directions of this trust agreement, the trustees is required to distribute all or any part of the principal of the trust herein created outright to a person who is then. Distributions to beneficiaries under legal age. The grantor, having effectively transferred all ownership of assets into the trust, legally removes all of their rights of. This agreement and the trusts created hereunder are irrevocable. This agreement lists the terms and conditions that are necessary for the entire arrangement. Be added from time to time, all of which is hereafter called the trust fund; and whereas, trustee accepts such trust and agrees to administer it in accordance with the terms and conditions of this agreement; An irrevocable trust cannot be, but in return you get extra estate tax benefits when transferring assets when you die. Irrevocable trusts are legal entities operated according to a trust agreement which is followed by the trustee. Last will and testament form 5 pages. In other words, once an irrevocable trust has been created, the written terms of the trust agreement are please note: If you create an irrevocable trust not long before a creditor receives a judgment against you, it's likely a court will find the transfer invalid. If you fall ill and can no longer manage your assets, this provision of the living trust agreement should include a named trustee to take over on. Irrevocable trusts cannot be modified, amended or terminated, except in. Now, therefore, trustor hereby gives trustee the property. The contents of samples of forms and documents are not intended to provide. The trustee is responsible for administrating the trust and making the distributions as described in the trust agreement. For an irrevocable trust agreement, the trustor grants control and ownership of the property to the trustee. This article is intended to provide some basic. This is distinguished from a revocable trust, which to create a trust, the grantor enters into a written trust agreement.

General Form Of Irrevocable Trust Agreement Us Legal Forms. In Other Words, Once An Irrevocable Trust Has Been Created, The Written Terms Of The Trust Agreement Are Please Note:

Sample Irrevocable Trust For California With Spendthrift Provision 2nv852jyz0lk. For an irrevocable trust agreement, the trustor grants control and ownership of the property to the trustee. Trust agreement this trust agreement (the. There are myriad irrevocable trusts available, most designed for specific types of asset protection and tax benefits. (f) to vote upon all securities belonging to the trusts, and to become a party to any stockholders' agreements deemed advisable by them in. This agreement made and entered into the ___ day of __ , __ , by. This trust shall be irrevocable and shall not be revoked or terminated by grantor or any other person, nor shall it be amended or altered by grantor or any other person. If at any time, in following the directions of this trust agreement, the trustees is required to distribute all or any part of the principal of the trust herein created outright to a person who is then. This agreement and the trusts created hereunder are irrevocable. Savesave irrevocable living trust agreement for later. If you create an irrevocable trust not long before a creditor receives a judgment against you, it's likely a court will find the transfer invalid. The grantor shall execute such further instruments as shall be necessary to vest the trustees with full title to the property which is the subject of this agreement. 100%(3)100% found this document useful (3 votes). All types of trust agreements are either irrevocable or revocable. A trust is a legal agreement by three parties that allows you as the trustor to transfer your property and assets to your beneficiaries. For this type of trust, the trustor no longer controls or owns the property which means that he can't make any.

Irrevocable Trust For Asset Protection Tutorial . An Irrevocable Trust Is One That By Its Design Can't Be Amended, Modified, Changed Or Revoked.

21 Printable Irrevocable Trust Form Florida Templates Fillable Samples In Pdf Word To Download Pdffiller. (f) to vote upon all securities belonging to the trusts, and to become a party to any stockholders' agreements deemed advisable by them in. There are myriad irrevocable trusts available, most designed for specific types of asset protection and tax benefits. If at any time, in following the directions of this trust agreement, the trustees is required to distribute all or any part of the principal of the trust herein created outright to a person who is then. 100%(3)100% found this document useful (3 votes). The grantor shall execute such further instruments as shall be necessary to vest the trustees with full title to the property which is the subject of this agreement. This agreement made and entered into the ___ day of __ , __ , by. All types of trust agreements are either irrevocable or revocable. This trust shall be irrevocable and shall not be revoked or terminated by grantor or any other person, nor shall it be amended or altered by grantor or any other person. For an irrevocable trust agreement, the trustor grants control and ownership of the property to the trustee. Savesave irrevocable living trust agreement for later.

50 Professional Trust Agreement Templates Forms Á Templatelab : This agreement lists the terms and conditions that are necessary for the entire arrangement.

Download Alabama Irrevocable Living Trust Form Pdf Rtf Word Freedownloads Net. This agreement and the trusts created hereunder are irrevocable. If you create an irrevocable trust not long before a creditor receives a judgment against you, it's likely a court will find the transfer invalid. 100%(3)100% found this document useful (3 votes). A trust is a legal agreement by three parties that allows you as the trustor to transfer your property and assets to your beneficiaries. (f) to vote upon all securities belonging to the trusts, and to become a party to any stockholders' agreements deemed advisable by them in. This trust shall be irrevocable and shall not be revoked or terminated by grantor or any other person, nor shall it be amended or altered by grantor or any other person. For an irrevocable trust agreement, the trustor grants control and ownership of the property to the trustee. The grantor shall execute such further instruments as shall be necessary to vest the trustees with full title to the property which is the subject of this agreement. Savesave irrevocable living trust agreement for later. All types of trust agreements are either irrevocable or revocable. This agreement made and entered into the ___ day of __ , __ , by. There are myriad irrevocable trusts available, most designed for specific types of asset protection and tax benefits. For this type of trust, the trustor no longer controls or owns the property which means that he can't make any. Trust agreement this trust agreement (the. If at any time, in following the directions of this trust agreement, the trustees is required to distribute all or any part of the principal of the trust herein created outright to a person who is then.

Arizona Irrevocable Trust Template Fill Online Printable Fillable Blank Pdffiller . This Is Distinguished From A Revocable Trust, Which To Create A Trust, The Grantor Enters Into A Written Trust Agreement.

Lovely Revocable Trust Agreement Form Models Form Ideas. The grantor shall execute such further instruments as shall be necessary to vest the trustees with full title to the property which is the subject of this agreement. For an irrevocable trust agreement, the trustor grants control and ownership of the property to the trustee. Savesave irrevocable living trust agreement for later. This agreement and the trusts created hereunder are irrevocable. A trust is a legal agreement by three parties that allows you as the trustor to transfer your property and assets to your beneficiaries. (f) to vote upon all securities belonging to the trusts, and to become a party to any stockholders' agreements deemed advisable by them in. This trust shall be irrevocable and shall not be revoked or terminated by grantor or any other person, nor shall it be amended or altered by grantor or any other person. All types of trust agreements are either irrevocable or revocable. For this type of trust, the trustor no longer controls or owns the property which means that he can't make any. This agreement made and entered into the ___ day of __ , __ , by. Trust agreement this trust agreement (the. If at any time, in following the directions of this trust agreement, the trustees is required to distribute all or any part of the principal of the trust herein created outright to a person who is then. There are myriad irrevocable trusts available, most designed for specific types of asset protection and tax benefits. 100%(3)100% found this document useful (3 votes). If you create an irrevocable trust not long before a creditor receives a judgment against you, it's likely a court will find the transfer invalid.

Sample Irrevocable Trust For California . Be Added From Time To Time, All Of Which Is Hereafter Called The Trust Fund; And Whereas, Trustee Accepts Such Trust And Agrees To Administer It In Accordance With The Terms And Conditions Of This Agreement;

Free Revocable Living Trust Create Download And Print Lawdepot Us. (f) to vote upon all securities belonging to the trusts, and to become a party to any stockholders' agreements deemed advisable by them in. This agreement made and entered into the ___ day of __ , __ , by. For an irrevocable trust agreement, the trustor grants control and ownership of the property to the trustee. This agreement and the trusts created hereunder are irrevocable. If you create an irrevocable trust not long before a creditor receives a judgment against you, it's likely a court will find the transfer invalid. Trust agreement this trust agreement (the. All types of trust agreements are either irrevocable or revocable. A trust is a legal agreement by three parties that allows you as the trustor to transfer your property and assets to your beneficiaries. If at any time, in following the directions of this trust agreement, the trustees is required to distribute all or any part of the principal of the trust herein created outright to a person who is then. The grantor shall execute such further instruments as shall be necessary to vest the trustees with full title to the property which is the subject of this agreement. Savesave irrevocable living trust agreement for later. 100%(3)100% found this document useful (3 votes). This trust shall be irrevocable and shall not be revoked or terminated by grantor or any other person, nor shall it be amended or altered by grantor or any other person. For this type of trust, the trustor no longer controls or owns the property which means that he can't make any. There are myriad irrevocable trusts available, most designed for specific types of asset protection and tax benefits.

Download California Irrevocable Living Trust Form Pdf Rtf Word Freedownloads Net . If At Any Time, In Following The Directions Of This Trust Agreement, The Trustees Is Required To Distribute All Or Any Part Of The Principal Of The Trust Herein Created Outright To A Person Who Is Then.

Free 5 Trust Agreement Contract Forms In Pdf. 100%(3)100% found this document useful (3 votes). This agreement and the trusts created hereunder are irrevocable. This agreement made and entered into the ___ day of __ , __ , by. For an irrevocable trust agreement, the trustor grants control and ownership of the property to the trustee. If you create an irrevocable trust not long before a creditor receives a judgment against you, it's likely a court will find the transfer invalid. All types of trust agreements are either irrevocable or revocable. Savesave irrevocable living trust agreement for later. The grantor shall execute such further instruments as shall be necessary to vest the trustees with full title to the property which is the subject of this agreement. A trust is a legal agreement by three parties that allows you as the trustor to transfer your property and assets to your beneficiaries. There are myriad irrevocable trusts available, most designed for specific types of asset protection and tax benefits. Trust agreement this trust agreement (the. (f) to vote upon all securities belonging to the trusts, and to become a party to any stockholders' agreements deemed advisable by them in. For this type of trust, the trustor no longer controls or owns the property which means that he can't make any. If at any time, in following the directions of this trust agreement, the trustees is required to distribute all or any part of the principal of the trust herein created outright to a person who is then. This trust shall be irrevocable and shall not be revoked or terminated by grantor or any other person, nor shall it be amended or altered by grantor or any other person.

50 Professional Trust Agreement Templates Forms Á Templatelab - Separate Trusts For Sample Children.

Revocable Living Trust And How It Works. The grantor shall execute such further instruments as shall be necessary to vest the trustees with full title to the property which is the subject of this agreement. For an irrevocable trust agreement, the trustor grants control and ownership of the property to the trustee. 100%(3)100% found this document useful (3 votes). Savesave irrevocable living trust agreement for later. If at any time, in following the directions of this trust agreement, the trustees is required to distribute all or any part of the principal of the trust herein created outright to a person who is then. Trust agreement this trust agreement (the. All types of trust agreements are either irrevocable or revocable. This agreement and the trusts created hereunder are irrevocable. (f) to vote upon all securities belonging to the trusts, and to become a party to any stockholders' agreements deemed advisable by them in. A trust is a legal agreement by three parties that allows you as the trustor to transfer your property and assets to your beneficiaries. There are myriad irrevocable trusts available, most designed for specific types of asset protection and tax benefits. This trust shall be irrevocable and shall not be revoked or terminated by grantor or any other person, nor shall it be amended or altered by grantor or any other person. For this type of trust, the trustor no longer controls or owns the property which means that he can't make any. This agreement made and entered into the ___ day of __ , __ , by. If you create an irrevocable trust not long before a creditor receives a judgment against you, it's likely a court will find the transfer invalid.

50 Professional Trust Agreement Templates Forms Á Templatelab : He Or She Names A Trustee To Hold The Property According To The Terms Of This Trust.

Fillable Online Dnr Missouri Sample Missouri Irrevocable Trust Form Fax Email Print Pdffiller. For an irrevocable trust agreement, the trustor grants control and ownership of the property to the trustee. 100%(3)100% found this document useful (3 votes). Savesave irrevocable living trust agreement for later. Trust agreement this trust agreement (the. For this type of trust, the trustor no longer controls or owns the property which means that he can't make any. The grantor shall execute such further instruments as shall be necessary to vest the trustees with full title to the property which is the subject of this agreement. A trust is a legal agreement by three parties that allows you as the trustor to transfer your property and assets to your beneficiaries. This agreement made and entered into the ___ day of __ , __ , by. All types of trust agreements are either irrevocable or revocable. (f) to vote upon all securities belonging to the trusts, and to become a party to any stockholders' agreements deemed advisable by them in. If you create an irrevocable trust not long before a creditor receives a judgment against you, it's likely a court will find the transfer invalid. If at any time, in following the directions of this trust agreement, the trustees is required to distribute all or any part of the principal of the trust herein created outright to a person who is then. This agreement and the trusts created hereunder are irrevocable. There are myriad irrevocable trusts available, most designed for specific types of asset protection and tax benefits. This trust shall be irrevocable and shall not be revoked or terminated by grantor or any other person, nor shall it be amended or altered by grantor or any other person.

Living Trust Agreement Template Word Pdf . The Grantor Shall Execute Such Further Instruments As Shall Be Necessary To Vest The Trustees With Full Title To The Property Which Is The Subject Of This Agreement.

Living Trust Form Revocable Living Trust With Sample Living Trust Revocable Living Trust Revocable Trust. There are myriad irrevocable trusts available, most designed for specific types of asset protection and tax benefits. Trust agreement this trust agreement (the. This trust shall be irrevocable and shall not be revoked or terminated by grantor or any other person, nor shall it be amended or altered by grantor or any other person. For an irrevocable trust agreement, the trustor grants control and ownership of the property to the trustee. All types of trust agreements are either irrevocable or revocable. For this type of trust, the trustor no longer controls or owns the property which means that he can't make any. This agreement and the trusts created hereunder are irrevocable. If at any time, in following the directions of this trust agreement, the trustees is required to distribute all or any part of the principal of the trust herein created outright to a person who is then. If you create an irrevocable trust not long before a creditor receives a judgment against you, it's likely a court will find the transfer invalid. The grantor shall execute such further instruments as shall be necessary to vest the trustees with full title to the property which is the subject of this agreement. (f) to vote upon all securities belonging to the trusts, and to become a party to any stockholders' agreements deemed advisable by them in. A trust is a legal agreement by three parties that allows you as the trustor to transfer your property and assets to your beneficiaries. Savesave irrevocable living trust agreement for later. This agreement made and entered into the ___ day of __ , __ , by. 100%(3)100% found this document useful (3 votes).

50 Professional Trust Agreement Templates Forms Á Templatelab : For An Irrevocable Trust Agreement, The Trustor Grants Control And Ownership Of The Property To The Trustee.

Free Living Trust Free To Print Save Download. For an irrevocable trust agreement, the trustor grants control and ownership of the property to the trustee. This agreement and the trusts created hereunder are irrevocable. Trust agreement this trust agreement (the. There are myriad irrevocable trusts available, most designed for specific types of asset protection and tax benefits. Savesave irrevocable living trust agreement for later. If at any time, in following the directions of this trust agreement, the trustees is required to distribute all or any part of the principal of the trust herein created outright to a person who is then. This trust shall be irrevocable and shall not be revoked or terminated by grantor or any other person, nor shall it be amended or altered by grantor or any other person. If you create an irrevocable trust not long before a creditor receives a judgment against you, it's likely a court will find the transfer invalid. The grantor shall execute such further instruments as shall be necessary to vest the trustees with full title to the property which is the subject of this agreement. This agreement made and entered into the ___ day of __ , __ , by. A trust is a legal agreement by three parties that allows you as the trustor to transfer your property and assets to your beneficiaries. For this type of trust, the trustor no longer controls or owns the property which means that he can't make any. All types of trust agreements are either irrevocable or revocable. (f) to vote upon all securities belonging to the trusts, and to become a party to any stockholders' agreements deemed advisable by them in. 100%(3)100% found this document useful (3 votes).