Download Unsecured Loan Agreement Template Pics. This means that if the borrower does not pay back the lender then the lender will have to take the borrower to small claims in order to court order for the borrower to pay back the money. It is wise to follow a template to get an idea of what should be included and what should be avoided in a loan. An agreement between a lender, who may be an individual or a corporate body, and a borrower, who is a individual person (or a company). You can include a guarantor which is a great way to protect the lender, however if the borrower does not pay you back you may have to take legal. Provisions to protect the lender. A loan agreement template would be beneficial to use when one is going to decide the terms for a specific loan. Unsecured means exactly that, there is no security against the loan should the borrower default. Likely to be used for family loan arrangement or loan to director by his own company. Create a high quality document online now! The loan is unsecured with no guarantor. This agreement can be used in any situation where the lender does not require or is willing to forgo security in case of default. Loan agreement templates (write a perfect loan agreement). Learn more about unsecured loan agreement, which is a document covering the terms of an agreement for you to borrow money from somebody to sign up for a 1 week free trial of lawbite access, giving you access to 3 document template downloads of your choice, discounted legal advice. This is signed when the loan is given and received on some terms and conditions. Unsecured note for the loans that don't require collateral and the lenders have their own methods of securing the borrowed money.

Download Unsecured Loan Agreement Template Pics: These Loan Agreements Also Specify Situations Where The Loan Will Be Immediately Repayable To The Lender, For Example, Where The Agreement Is Breached.

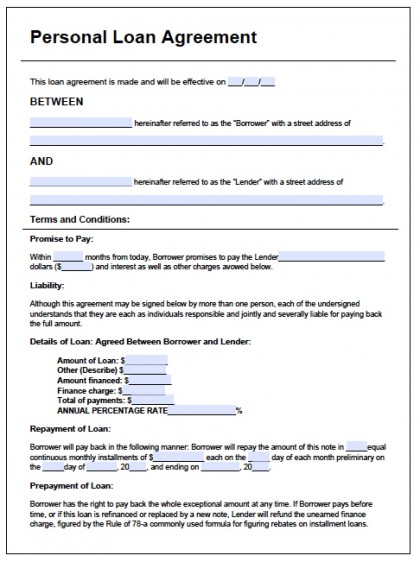

Loan Agreement Template Download Loan Agreement Sample. An agreement between a lender, who may be an individual or a corporate body, and a borrower, who is a individual person (or a company). A loan agreement template would be beneficial to use when one is going to decide the terms for a specific loan. Loan agreement templates (write a perfect loan agreement). This means that if the borrower does not pay back the lender then the lender will have to take the borrower to small claims in order to court order for the borrower to pay back the money. This agreement can be used in any situation where the lender does not require or is willing to forgo security in case of default. Learn more about unsecured loan agreement, which is a document covering the terms of an agreement for you to borrow money from somebody to sign up for a 1 week free trial of lawbite access, giving you access to 3 document template downloads of your choice, discounted legal advice. Unsecured note for the loans that don't require collateral and the lenders have their own methods of securing the borrowed money. You can include a guarantor which is a great way to protect the lender, however if the borrower does not pay you back you may have to take legal. Unsecured means exactly that, there is no security against the loan should the borrower default. Likely to be used for family loan arrangement or loan to director by his own company. It is wise to follow a template to get an idea of what should be included and what should be avoided in a loan. This is signed when the loan is given and received on some terms and conditions. The loan is unsecured with no guarantor. Provisions to protect the lender. Create a high quality document online now!

This is signed when the loan is given and received on some terms and conditions.

Try this money lending agreement template for free. Unsecured loan is the loan that does not require the borrower to deposit any property as security for. A loan agreement is a contract document between the lender and the borrower. Likely to be used for family loan arrangement or loan to director by his own company. You can include a guarantor which is a great way to protect the lender, however if the borrower does not pay you back you may have to take legal. The loan is unsecured with no guarantor. The loan agreement outlines the parties to the loan, the amount which is loaned, the interest rate about the template. The loan documents are available to download instantly. The legalvision loan agreement is a short form, unsecured loan deed. You must be familiar with the various categories of loans, and in each of these cases, there are certain conditions that both the parties need to stick to. An agreement between a lender, who may be an individual or a corporate body, and a borrower, who is a individual person (or a company). Best loan agreement sample is available for download free on this page. Learn more about unsecured loan agreement, which is a document covering the terms of an agreement for you to borrow money from somebody to sign up for a 1 week free trial of lawbite access, giving you access to 3 document template downloads of your choice, discounted legal advice. It is suitable for use whether the lender or this template has been recently updated to provide customers with different repayment options. It is wise to follow a template to get an idea of what should be included and what should be avoided in a loan. Loan agreement templates (write a perfect loan agreement). We offer two types of agreements; Can be used where the lender and borrower are either businesses or individuals. Provisions to protect the lender. This means that if the borrower does not pay back the lender then the lender will have to take the borrower to small claims in order to court order for the borrower to pay back the money. Ownership this loan agreement is not transferable. Here we discuss the definition and important features of unsecured loans along with practical examples. This loan agreement is a legal kind of a thing and all the terms both while handing over and taking over are written in clear and easily understandable language so that there is no difference of opinion at a later stage. And after calculating, you find out that you can take an unsecured loan from the bank and the rest of the amount you can pay from your savings and from. A professionally drawn unsecured loan agreement template for many lending arrangements, for example, between friends or to director by his own company. This loan agreement template makes use of pandadoc's tokens, text fields, and date fields to make it easy for the lender and borrower to complete and sign the document. Guide to an unsecured loan. An unsecured loan agreement which is suitable for individuals or businesses and an unsecured loan agreement with guarantor for. To get started, fill out the tokens using the menu on the right. Create a high quality document online now! This loan agreement clearly and carefully regulates the making of a term loan.

Loan Agreement Template Corporate Borrower Secured By Guarantee. A Written Content Of Both Parties Is Needed In Order To Transfer This Agreement.

Release Of Loan Agreement Template Word Pdf. Create a high quality document online now! You can include a guarantor which is a great way to protect the lender, however if the borrower does not pay you back you may have to take legal. Unsecured means exactly that, there is no security against the loan should the borrower default. The loan is unsecured with no guarantor. Provisions to protect the lender. Learn more about unsecured loan agreement, which is a document covering the terms of an agreement for you to borrow money from somebody to sign up for a 1 week free trial of lawbite access, giving you access to 3 document template downloads of your choice, discounted legal advice. An agreement between a lender, who may be an individual or a corporate body, and a borrower, who is a individual person (or a company). Unsecured note for the loans that don't require collateral and the lenders have their own methods of securing the borrowed money. It is wise to follow a template to get an idea of what should be included and what should be avoided in a loan. A loan agreement template would be beneficial to use when one is going to decide the terms for a specific loan. This is signed when the loan is given and received on some terms and conditions. This means that if the borrower does not pay back the lender then the lender will have to take the borrower to small claims in order to court order for the borrower to pay back the money. This agreement can be used in any situation where the lender does not require or is willing to forgo security in case of default. Loan agreement templates (write a perfect loan agreement). Likely to be used for family loan arrangement or loan to director by his own company.

Division 7a Company Loan Agreement Template . This Means That If The Borrower Does Not Pay Back The Lender Then The Lender Will Have To Take The Borrower To Small Claims In Order To Court Order For The Borrower To Pay Back The Money.

How To Make A Car Loan Agreement Form Templates Free Premium Templates. This means that if the borrower does not pay back the lender then the lender will have to take the borrower to small claims in order to court order for the borrower to pay back the money. An agreement between a lender, who may be an individual or a corporate body, and a borrower, who is a individual person (or a company). Learn more about unsecured loan agreement, which is a document covering the terms of an agreement for you to borrow money from somebody to sign up for a 1 week free trial of lawbite access, giving you access to 3 document template downloads of your choice, discounted legal advice. It is wise to follow a template to get an idea of what should be included and what should be avoided in a loan. This agreement can be used in any situation where the lender does not require or is willing to forgo security in case of default. Unsecured means exactly that, there is no security against the loan should the borrower default. Likely to be used for family loan arrangement or loan to director by his own company. Loan agreement templates (write a perfect loan agreement). Unsecured note for the loans that don't require collateral and the lenders have their own methods of securing the borrowed money. The loan is unsecured with no guarantor.

Free Loan Agreement Templates Pdf Word Eforms Free Fillable Forms : Our loan agreement templates have professionally drafted.

38 Free Loan Agreement Templates Forms Word Pdf. Learn more about unsecured loan agreement, which is a document covering the terms of an agreement for you to borrow money from somebody to sign up for a 1 week free trial of lawbite access, giving you access to 3 document template downloads of your choice, discounted legal advice. This agreement can be used in any situation where the lender does not require or is willing to forgo security in case of default. Provisions to protect the lender. Unsecured note for the loans that don't require collateral and the lenders have their own methods of securing the borrowed money. Loan agreement templates (write a perfect loan agreement). Create a high quality document online now! This is signed when the loan is given and received on some terms and conditions. You can include a guarantor which is a great way to protect the lender, however if the borrower does not pay you back you may have to take legal. Likely to be used for family loan arrangement or loan to director by his own company. A loan agreement template would be beneficial to use when one is going to decide the terms for a specific loan. An agreement between a lender, who may be an individual or a corporate body, and a borrower, who is a individual person (or a company). This means that if the borrower does not pay back the lender then the lender will have to take the borrower to small claims in order to court order for the borrower to pay back the money. Unsecured means exactly that, there is no security against the loan should the borrower default. The loan is unsecured with no guarantor. It is wise to follow a template to get an idea of what should be included and what should be avoided in a loan.

Free 35 Loan Agreement Forms In Pdf : To Get Started, Fill Out The Tokens Using The Menu On The Right.

Free Printable Loan Agreement Form Form Generic. Unsecured means exactly that, there is no security against the loan should the borrower default. You can include a guarantor which is a great way to protect the lender, however if the borrower does not pay you back you may have to take legal. Loan agreement templates (write a perfect loan agreement). Learn more about unsecured loan agreement, which is a document covering the terms of an agreement for you to borrow money from somebody to sign up for a 1 week free trial of lawbite access, giving you access to 3 document template downloads of your choice, discounted legal advice. This means that if the borrower does not pay back the lender then the lender will have to take the borrower to small claims in order to court order for the borrower to pay back the money. A loan agreement template would be beneficial to use when one is going to decide the terms for a specific loan. Unsecured note for the loans that don't require collateral and the lenders have their own methods of securing the borrowed money. An agreement between a lender, who may be an individual or a corporate body, and a borrower, who is a individual person (or a company). This agreement can be used in any situation where the lender does not require or is willing to forgo security in case of default. It is wise to follow a template to get an idea of what should be included and what should be avoided in a loan. This is signed when the loan is given and received on some terms and conditions. The loan is unsecured with no guarantor. Likely to be used for family loan arrangement or loan to director by his own company. Create a high quality document online now! Provisions to protect the lender.

Unsecured Forgivable Promissory Note Fill Online Printable Fillable Blank Pdffiller : You Can Include A Guarantor Which Is A Great Way To Protect The Lender, However If The Borrower Does Not Pay You Back You May Have To Take Legal.

Florida Unsecured Promissory Note Template Promissory Notes Promissory Notes. A loan agreement template would be beneficial to use when one is going to decide the terms for a specific loan. Likely to be used for family loan arrangement or loan to director by his own company. Create a high quality document online now! Learn more about unsecured loan agreement, which is a document covering the terms of an agreement for you to borrow money from somebody to sign up for a 1 week free trial of lawbite access, giving you access to 3 document template downloads of your choice, discounted legal advice. An agreement between a lender, who may be an individual or a corporate body, and a borrower, who is a individual person (or a company). Loan agreement templates (write a perfect loan agreement). The loan is unsecured with no guarantor. Provisions to protect the lender. Unsecured note for the loans that don't require collateral and the lenders have their own methods of securing the borrowed money. This agreement can be used in any situation where the lender does not require or is willing to forgo security in case of default. This is signed when the loan is given and received on some terms and conditions. This means that if the borrower does not pay back the lender then the lender will have to take the borrower to small claims in order to court order for the borrower to pay back the money. You can include a guarantor which is a great way to protect the lender, however if the borrower does not pay you back you may have to take legal. It is wise to follow a template to get an idea of what should be included and what should be avoided in a loan. Unsecured means exactly that, there is no security against the loan should the borrower default.

Loan Agreement Sample Template Online Word And Pdf - Download This Loan Agreement Template To Set The Terms Of The Loan With The Other Party, Including Payment Plan And Term Length.

Michigan Unsecured Promissory Note Template Promissory Notes Promissory Notes. You can include a guarantor which is a great way to protect the lender, however if the borrower does not pay you back you may have to take legal. It is wise to follow a template to get an idea of what should be included and what should be avoided in a loan. A loan agreement template would be beneficial to use when one is going to decide the terms for a specific loan. Learn more about unsecured loan agreement, which is a document covering the terms of an agreement for you to borrow money from somebody to sign up for a 1 week free trial of lawbite access, giving you access to 3 document template downloads of your choice, discounted legal advice. This agreement can be used in any situation where the lender does not require or is willing to forgo security in case of default. Loan agreement templates (write a perfect loan agreement). The loan is unsecured with no guarantor. Provisions to protect the lender. This is signed when the loan is given and received on some terms and conditions. This means that if the borrower does not pay back the lender then the lender will have to take the borrower to small claims in order to court order for the borrower to pay back the money. Create a high quality document online now! Unsecured means exactly that, there is no security against the loan should the borrower default. Unsecured note for the loans that don't require collateral and the lenders have their own methods of securing the borrowed money. Likely to be used for family loan arrangement or loan to director by his own company. An agreement between a lender, who may be an individual or a corporate body, and a borrower, who is a individual person (or a company).

Template Unsecured Subordinated Loan Agreement Doc Template Pdffiller - This Loan Agreement Template Is Available For Use On Upcounsel.

38 Free Loan Agreement Templates Forms Word Pdf. Loan agreement templates (write a perfect loan agreement). Create a high quality document online now! This is signed when the loan is given and received on some terms and conditions. Learn more about unsecured loan agreement, which is a document covering the terms of an agreement for you to borrow money from somebody to sign up for a 1 week free trial of lawbite access, giving you access to 3 document template downloads of your choice, discounted legal advice. It is wise to follow a template to get an idea of what should be included and what should be avoided in a loan. Unsecured note for the loans that don't require collateral and the lenders have their own methods of securing the borrowed money. This means that if the borrower does not pay back the lender then the lender will have to take the borrower to small claims in order to court order for the borrower to pay back the money. The loan is unsecured with no guarantor. You can include a guarantor which is a great way to protect the lender, however if the borrower does not pay you back you may have to take legal. This agreement can be used in any situation where the lender does not require or is willing to forgo security in case of default. Likely to be used for family loan arrangement or loan to director by his own company. An agreement between a lender, who may be an individual or a corporate body, and a borrower, who is a individual person (or a company). Provisions to protect the lender. A loan agreement template would be beneficial to use when one is going to decide the terms for a specific loan. Unsecured means exactly that, there is no security against the loan should the borrower default.

How To Make A Car Loan Agreement Form Templates Free Premium Templates - Unsecured Means Exactly That, There Is No Security Against The Loan Should The Borrower Default.

Free Loan Agreement Template Simple Personal Employee Family. Learn more about unsecured loan agreement, which is a document covering the terms of an agreement for you to borrow money from somebody to sign up for a 1 week free trial of lawbite access, giving you access to 3 document template downloads of your choice, discounted legal advice. This is signed when the loan is given and received on some terms and conditions. This means that if the borrower does not pay back the lender then the lender will have to take the borrower to small claims in order to court order for the borrower to pay back the money. Provisions to protect the lender. You can include a guarantor which is a great way to protect the lender, however if the borrower does not pay you back you may have to take legal. An agreement between a lender, who may be an individual or a corporate body, and a borrower, who is a individual person (or a company). The loan is unsecured with no guarantor. Create a high quality document online now! Unsecured note for the loans that don't require collateral and the lenders have their own methods of securing the borrowed money. Unsecured means exactly that, there is no security against the loan should the borrower default. This agreement can be used in any situation where the lender does not require or is willing to forgo security in case of default. Likely to be used for family loan arrangement or loan to director by his own company. A loan agreement template would be beneficial to use when one is going to decide the terms for a specific loan. Loan agreement templates (write a perfect loan agreement). It is wise to follow a template to get an idea of what should be included and what should be avoided in a loan.

Loan Agreement Template Free Simple Loan Agreement Sample Pdf Formswift - To Get Started, Fill Out The Tokens Using The Menu On The Right.

10 Free Sample Security Agreement Templates Printable Samples. Provisions to protect the lender. This means that if the borrower does not pay back the lender then the lender will have to take the borrower to small claims in order to court order for the borrower to pay back the money. Likely to be used for family loan arrangement or loan to director by his own company. Unsecured means exactly that, there is no security against the loan should the borrower default. This is signed when the loan is given and received on some terms and conditions. Loan agreement templates (write a perfect loan agreement). The loan is unsecured with no guarantor. You can include a guarantor which is a great way to protect the lender, however if the borrower does not pay you back you may have to take legal. An agreement between a lender, who may be an individual or a corporate body, and a borrower, who is a individual person (or a company). It is wise to follow a template to get an idea of what should be included and what should be avoided in a loan. Learn more about unsecured loan agreement, which is a document covering the terms of an agreement for you to borrow money from somebody to sign up for a 1 week free trial of lawbite access, giving you access to 3 document template downloads of your choice, discounted legal advice. A loan agreement template would be beneficial to use when one is going to decide the terms for a specific loan. Create a high quality document online now! This agreement can be used in any situation where the lender does not require or is willing to forgo security in case of default. Unsecured note for the loans that don't require collateral and the lenders have their own methods of securing the borrowed money.

Personal Loan Forms Template New Personal Loan Agreement In 2020 Private Loans Personal Loans Contract Template . Best Loan Agreement Sample Is Available For Download Free On This Page.

Personal Loan Forms Template New Personal Loan Agreement In 2020 Private Loans Personal Loans Contract Template. Provisions to protect the lender. You can include a guarantor which is a great way to protect the lender, however if the borrower does not pay you back you may have to take legal. This agreement can be used in any situation where the lender does not require or is willing to forgo security in case of default. Likely to be used for family loan arrangement or loan to director by his own company. Loan agreement templates (write a perfect loan agreement). The loan is unsecured with no guarantor. This is signed when the loan is given and received on some terms and conditions. Unsecured means exactly that, there is no security against the loan should the borrower default. Unsecured note for the loans that don't require collateral and the lenders have their own methods of securing the borrowed money. Learn more about unsecured loan agreement, which is a document covering the terms of an agreement for you to borrow money from somebody to sign up for a 1 week free trial of lawbite access, giving you access to 3 document template downloads of your choice, discounted legal advice. Create a high quality document online now! It is wise to follow a template to get an idea of what should be included and what should be avoided in a loan. An agreement between a lender, who may be an individual or a corporate body, and a borrower, who is a individual person (or a company). This means that if the borrower does not pay back the lender then the lender will have to take the borrower to small claims in order to court order for the borrower to pay back the money. A loan agreement template would be beneficial to use when one is going to decide the terms for a specific loan.